The Ultimate Guide To Clark Wealth Partners

Table of ContentsClark Wealth Partners for BeginnersClark Wealth Partners for BeginnersGetting My Clark Wealth Partners To WorkThe 2-Minute Rule for Clark Wealth PartnersThe Only Guide for Clark Wealth PartnersThe 30-Second Trick For Clark Wealth PartnersLittle Known Questions About Clark Wealth Partners.About Clark Wealth Partners

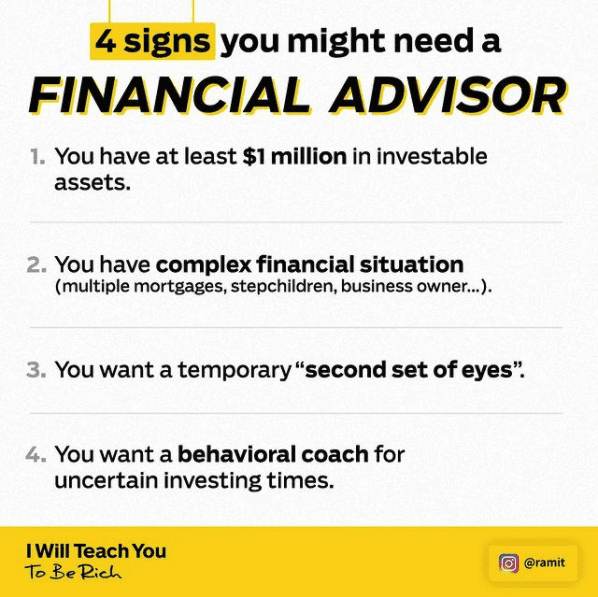

Common reasons to think about a monetary consultant are: If your economic scenario has ended up being much more complex, or you do not have self-confidence in your money-managing skills. Conserving or browsing significant life occasions like marriage, separation, children, inheritance, or work adjustment that may significantly affect your economic scenario. Navigating the shift from conserving for retired life to preserving wealth during retirement and exactly how to develop a strong retired life earnings plan.New modern technology has actually led to even more thorough automated financial devices, like robo-advisors. It's up to you to explore and identify the appropriate fit - https://www.domestika.org/en/clrkwlthprtnr. Inevitably, a good monetary expert ought to be as conscious of your investments as they are with their own, staying clear of extreme fees, conserving cash on tax obligations, and being as clear as feasible concerning your gains and losses

Fascination About Clark Wealth Partners

Gaining a commission on product suggestions does not always mean your fee-based advisor works versus your ideal rate of interests. They may be much more inclined to recommend products and solutions on which they make a payment, which might or may not be in your finest rate of interest. A fiduciary is legitimately bound to place their client's interests.

This basic allows them to make suggestions for financial investments and solutions as long as they match their client's goals, threat resistance, and economic scenario. On the other hand, fiduciary consultants are lawfully bound to act in their customer's best rate of interest rather than their very own.

The 10-Minute Rule for Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving into complicated monetary subjects, clarifying lesser-known investment methods, and uncovering ways readers can work the system to their advantage. As a personal financing professional in her 20s, Tessa is acutely knowledgeable about the impacts time and uncertainty carry your investment decisions.

It was a targeted advertisement, and it worked. Learn more Review much less.

The Clark Wealth Partners PDFs

There's no solitary route to ending up being one, with some individuals beginning in banking or insurance, while others start in accounting. A four-year degree offers a strong foundation for professions in financial investments, budgeting, and client solutions.

Indicators on Clark Wealth Partners You Need To Know

Typical instances consist of the FINRA Series 7 and index Series 65 examinations for safety and securities, or a state-issued insurance policy permit for offering life or wellness insurance coverage. While qualifications might not be legitimately required for all planning functions, employers and customers usually see them as a criteria of professionalism and trust. We check out optional credentials in the following section.

The majority of economic planners have 1-3 years of experience and familiarity with economic items, compliance requirements, and direct customer interaction. A strong instructional history is vital, yet experience demonstrates the capability to apply theory in real-world setups. Some programs combine both, permitting you to complete coursework while earning monitored hours with internships and practicums.

3 Easy Facts About Clark Wealth Partners Explained

Very early years can bring lengthy hours, stress to construct a client base, and the demand to constantly verify your expertise. Financial coordinators take pleasure in the possibility to work closely with clients, overview crucial life decisions, and frequently accomplish versatility in schedules or self-employment.

Riches supervisors can boost their revenues via compensations, asset fees, and efficiency benefits. Economic managers look after a team of monetary organizers and consultants, setting departmental approach, handling conformity, budgeting, and directing inner operations. They spent less time on the client-facing side of the industry. Almost all economic supervisors hold a bachelor's level, and lots of have an MBA or comparable graduate degree.

Some Known Incorrect Statements About Clark Wealth Partners

Optional qualifications, such as the CFP, usually call for additional coursework and testing, which can extend the timeline by a number of years. According to the Bureau of Labor Stats, personal monetary consultants gain a mean annual annual income of $102,140, with leading income earners gaining over $239,000.

In various other districts, there are guidelines that need them to meet particular demands to use the economic advisor or economic planner titles. For financial planners, there are 3 usual classifications: Licensed, Personal and Registered Financial Organizer.

The Definitive Guide to Clark Wealth Partners

Those on wage may have a reward to advertise the services and products their employers offer. Where to find an economic expert will rely on the kind of advice you need. These establishments have team who may aid you recognize and get particular sorts of financial investments. For instance, term down payments, guaranteed investment certificates (GICs) and shared funds.